can you ever owe money on stocks reddit

You could short a stock and long a call to cover the short position should things go against you. If you are at all interested in investing youve almost certainly heard of Robinhood.

![]()

Is Canadian Couch Potato Still Relevant These Days R Personalfinancecanada

A company can lose all its value which will likely translate into a declining stock price.

. Updated September 11 2021. This can happen when a stock is declining in value as well as when it is appreciating in value. Read customer reviews find best sellers.

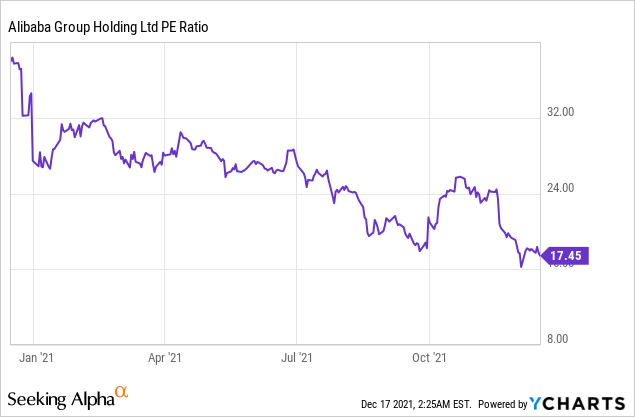

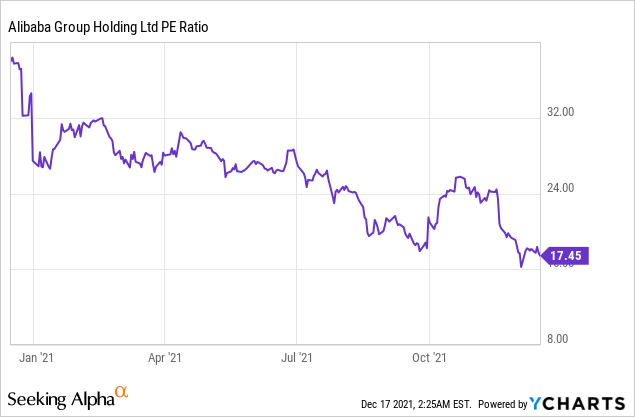

If not the dealership may pass that fee on to you. A little mean reversion here would mean a lot of outperformance for value. Answer 1 of 7.

Visit The Official Edward Jones Site. Selling Stocks on a Margin. If however the stock price went.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Yes you can lose any amount of money invested in stocks. Make sure your loan allows you to pay it off early.

The investing app is a favorite among everyday traders who congregate in online forums like Reddits rWallStreetBets and has surpassed 18 million active users since its launch in 2013. It really depends on whether youre buying stocks on a margin loan or with cash. To get back to the historical average ratio of 075 and assuming stable earnings value stocks would have to rise by about 30 per cent or growth stocks would have to fall by over 20 per cent or some combination of both.

Margin borrowing available at most brokerages allows investors to borrow money to buy stock. Stock prices also fluctuate depending on the supply and demand of the stock. If a stock drops to zero you can lose all the money youve invested.

If your stocks bonds mutual funds ETFs or other securities lose value you wont normally owe money to your brokerage. Lets get started today. Hopefully your broker wouldnt sign off on you trading options at that level of approval.

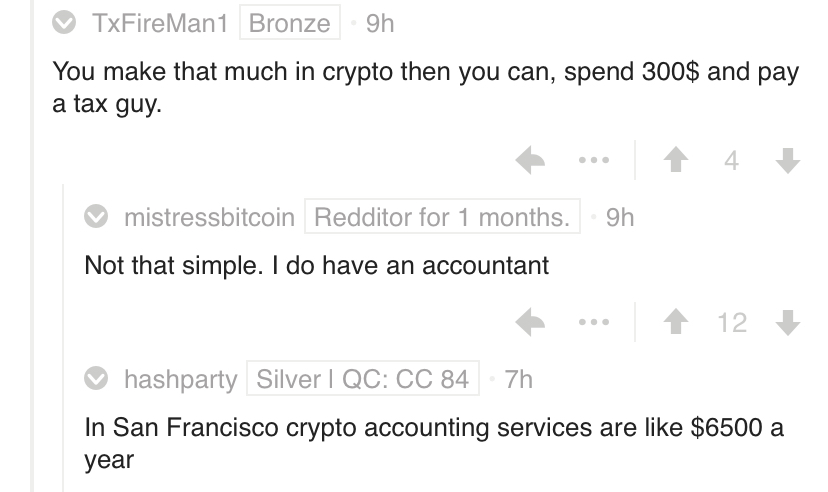

Let me simplify this for you even more--get to a trusted tax pro who can handle this for you while you run your business. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. Just an idea but there are many ways to accomplish what you want.

Even though the value of a stock can never go below zero it is possible to lose more than what you invested in the stock market and end up with a debt. It is possible but the dealership is simply going to add the remainder of the loan to the price of your new car. Penny stocks come with high risks and the potential for above-average returns and investing in them requires care and caution.

The simplest tax errors--including errors of omission--can be the most costly. Its not a good idea to trade in a car when you still owe money on the loan you purchased to buy that car. That would hedge some of your risk associated with shorting.

The ratio is 057. Lets take a look at the two possible situations when this can happen. My own view it is unadviseble to borrow for other than appreciating assets within an appropriate investment term.

Ad More Trading Hours More Potential Market Opportunities. Ad Browse discover thousands of brands. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Yes if you engage in margin trading you can be technically in debt. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000 or 100. The Silicon Valley darling which grew its following amid an investing surge during the COVID-19.

Trade 245 at TD Ameritrade. Ad Were all about helping you get more from your money. New Look At Your Financial Strategy.

However you may not receive all of your money back ifwhen you sell. You may owe money or shares which is essentially the same in practice.

Sara Finance Review 15 Things You Should Know Before Buying Sara Finance S Dropshipping Business Course Social Crawlytics

South Asia Debt Woes Evoke Fears Of Another 1997 Style Crisis Bnn Bloomberg

/GettyImages-11698550571-7d63bd56039541dea5effdacf31fd3b1.jpg)

What Happens If I Cannot Pay A Margin Call

Reddit Roasts The Irs Have America S Tax Collectors Gone Crypto Fishing Op Ed Bitcoin News

Reddit Vs Wall Street A Glorious Game Of Stonks Deccan Herald

Tax Planning For Canadians Who Invest In The U S Moneysense

Locked In 100k Profits Day Trading Lost It Now Owe Tax On 100k I Don T Have R Ausfinance

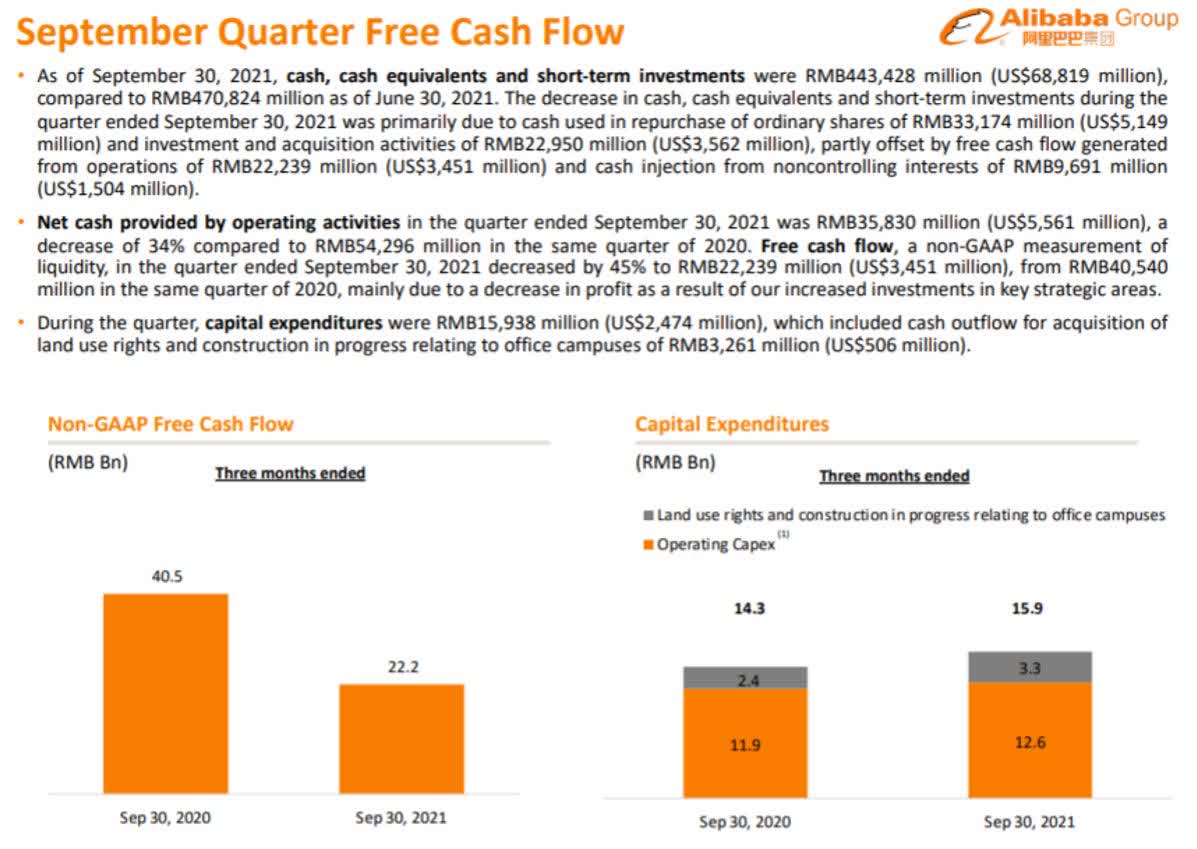

Alibaba A Fool And His Money Will Be Divided Soon Nyse Baba Seeking Alpha

Melvin Capital Hedge Fund Targeted By Reddit Board Closes Out Of Gamestop Short Position

Where Is The Us Government Getting All The Money It S Spending In The Coronavirus Crisis

/money_management_shutterstock_121962535-5bfc31cc46e0fb00260c4a81.jpg)

Should I Take My Money Out Of The Stock Market

Reddit Roasts The Irs Have America S Tax Collectors Gone Crypto Fishing Op Ed Bitcoin News

Eli5 How Is Futures Trading Any Riskier Than Regular Stocks If You Re Just Putting In The Same Amount Of Money To Potentially Lose R Explainlikeimfive

Alibaba A Fool And His Money Will Be Divided Soon Nyse Baba Seeking Alpha

Spacex Performing 10 For 1 Common Stock Split R Spacex

Melvin Capital Hedge Fund Targeted By Reddit Board Closes Out Of Gamestop Short Position

Why Do You Invest In Individual Stocks When You D Most Probably Be Better Off With Index Fund R Investing

A Beginner S Guide To Webull Tips For The Popular Stock App Money

Reddit Roasts The Irs Have America S Tax Collectors Gone Crypto Fishing Op Ed Bitcoin News